Hey guys!

I thought it would be interesting to share our 3a strategies for those of us who decide to go with a personalized Global100 with Viac or Finpension (or other providers, if possible). I only opened a VIAC account earlier this year, I was with BCV before, and did a lot of looking around to try to find the strategy that suited me best.

This is what my current allocation looks like:

iShares Core S&P500: 35%

Swisscanto World ex CH hedged: 29%

Swisscanto SMI (SPI 20): 15%

Swisscanto Europe ex CH: 10%

Swisscanto Emerging Markets: 10%

This strategy is: US (56%), EU (15%), CH (16%), Asia (11%), which I think is fairly diversified. What about you, what strategy do you use and which funds have you chosen?

I thought it would be interesting to share our 3a strategies for those of us who decide to go with a personalized Global100 with Viac or Finpension (or other providers, if possible). I only opened a VIAC account earlier this year, I was with BCV before, and did a lot of looking around to try to find the strategy that suited me best.

This is what my current allocation looks like:

iShares Core S&P500: 35%

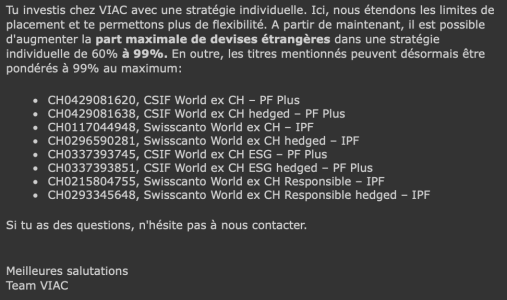

Swisscanto World ex CH hedged: 29%

Swisscanto SMI (SPI 20): 15%

Swisscanto Europe ex CH: 10%

Swisscanto Emerging Markets: 10%

This strategy is: US (56%), EU (15%), CH (16%), Asia (11%), which I think is fairly diversified. What about you, what strategy do you use and which funds have you chosen?