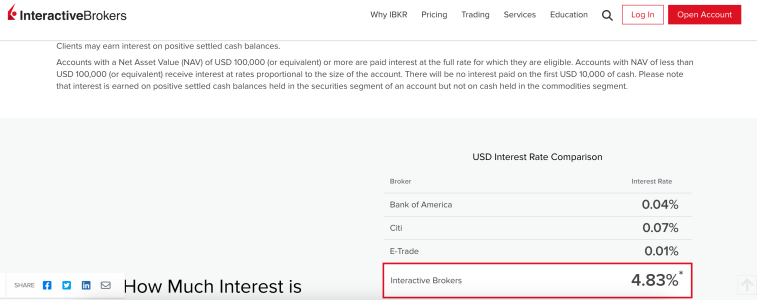

I know that a cash savings is for safety and shouldn't be optimised ... BUT ... the 4.2% interest I could get on our cash at Interactive Brokers is quite something.

Yes, that rate is if we keep it in USD and not CHF.

At UBS we get 0.75% I believe, and that's only recently.

Coming from the UK where we're used to free banking with good cash interest, it's just a hard thing to adjust to.

Is anyone keeping their cash in Interactive Brokers?

Yes, that rate is if we keep it in USD and not CHF.

At UBS we get 0.75% I believe, and that's only recently.

Coming from the UK where we're used to free banking with good cash interest, it's just a hard thing to adjust to.

Is anyone keeping their cash in Interactive Brokers?