Hi all.

I've very recently started to take (more) care about my finances (you might come across other posts of mine in this forum going in almost the same direction).

Now I got some really basic behaviour/how-to questions, which probably could go under the "ELI5" title - sorry for this! :-/

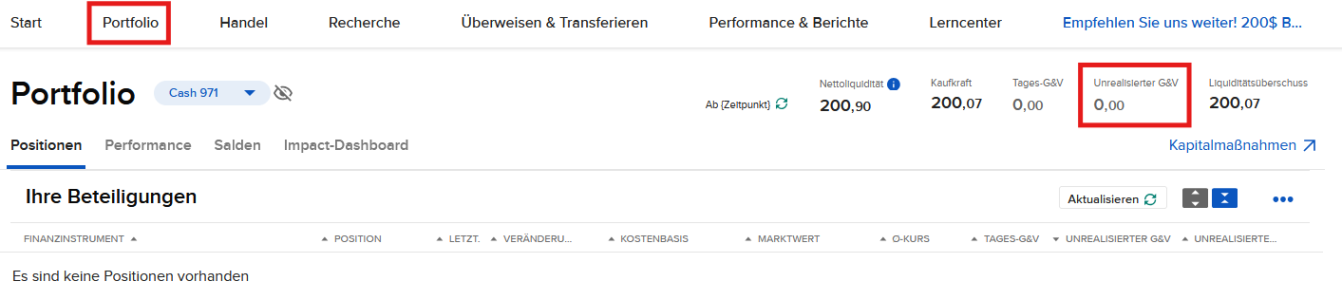

I've started with 10k on IBKR, fully invested in VANGUARD TOT WORLD STK ETF (VT). ATM I'm losing some money, but this is nothing that shakes me: I still have 20 years to go before retiring, therefore I'm looking at long-term investing. Here we go already with my first questions:

If/when my invested 10k will be worth more (e.g. 11k), what's suggested to be doing with the surplus? Just leave it there on VT? Or sell stocks? Or what else?

What would be the strategy to be followed in the next 20 years? I'm referring to the risk reduction when getting near retirement: I would understand that at some point (age 60? or earlier?) it would be safe to reduce the risk by lowering the amount of stocks in my portfolio in favour of bonds. Would that be correct?

Last (for this post) but not least: I've got around CHF 200k invested at UBS (75% stocks, 25% bonds - I can detail further if needed) which as of now are doing good (YTD ca. +7%). I'm willing to move this chunk over to IBKR and do a lump sum investment. Assuming that I'd like to maintain the same risk level (75% stocks, 25% bonds), what could my portfolio look like? VT is stocks, right? Therefore I would put 75% on VT (or would you suggest using different ETFs instead of just VT?) and 25% in bonds... but here I am stuck: I don't know which bonds could be good/worth it.

Also: UBS is of course "managing" my investments, whereas with IBKR I would be the one managing it. What's your way of dealing with this? Do you actively manage your portfolio (e.g. selling ETFs to buy other ETFs or bonds) on a daily basis? Or how do you handle it anyway?

TIA!

I've very recently started to take (more) care about my finances (you might come across other posts of mine in this forum going in almost the same direction).

Now I got some really basic behaviour/how-to questions, which probably could go under the "ELI5" title - sorry for this! :-/

I've started with 10k on IBKR, fully invested in VANGUARD TOT WORLD STK ETF (VT). ATM I'm losing some money, but this is nothing that shakes me: I still have 20 years to go before retiring, therefore I'm looking at long-term investing. Here we go already with my first questions:

If/when my invested 10k will be worth more (e.g. 11k), what's suggested to be doing with the surplus? Just leave it there on VT? Or sell stocks? Or what else?

What would be the strategy to be followed in the next 20 years? I'm referring to the risk reduction when getting near retirement: I would understand that at some point (age 60? or earlier?) it would be safe to reduce the risk by lowering the amount of stocks in my portfolio in favour of bonds. Would that be correct?

Last (for this post) but not least: I've got around CHF 200k invested at UBS (75% stocks, 25% bonds - I can detail further if needed) which as of now are doing good (YTD ca. +7%). I'm willing to move this chunk over to IBKR and do a lump sum investment. Assuming that I'd like to maintain the same risk level (75% stocks, 25% bonds), what could my portfolio look like? VT is stocks, right? Therefore I would put 75% on VT (or would you suggest using different ETFs instead of just VT?) and 25% in bonds... but here I am stuck: I don't know which bonds could be good/worth it.

Also: UBS is of course "managing" my investments, whereas with IBKR I would be the one managing it. What's your way of dealing with this? Do you actively manage your portfolio (e.g. selling ETFs to buy other ETFs or bonds) on a daily basis? Or how do you handle it anyway?

TIA!