Badomb

New member

Dear finance, investment and FIRE enthusiasts. Maybe a never-ending subject, but still an open question to me: HOW DO YOU MANAGE YOUR PERSONAL FINANCE?

I am talking about your system and tools here.

Let me elaborate on this:

- it is only at the age of 40 (unfortunately) I've started to take care of my finance, from tracking it, to start with

- based on data collected I've started to build trends and signals

- I even employed ChatGPT with my own agents to process data for me, as ChatGPT is great at analyzing unstructured data

- I use XLS as a tool, as I didn't find anything better

- as IT and Software Engineer and a Product Guy I want to believe there is a better place than XLS.

So, what's your system? How do you track it? How often? To which details? Which categories?

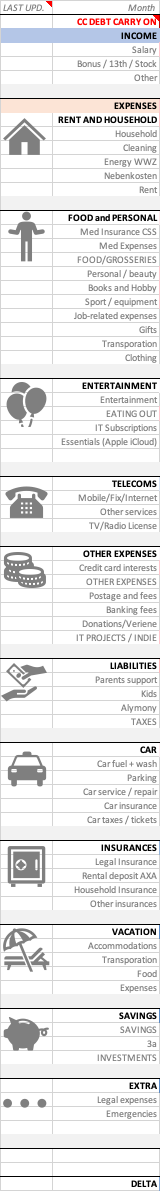

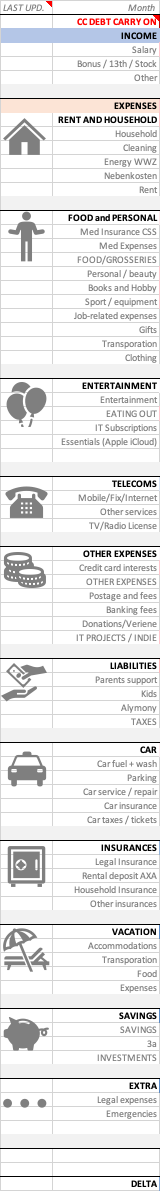

Below is a real example of categories that I use.

Then I have columns per month. Actual CF, not planned. Not deviation analyses between PLAN vs. ACTUAL. Not sure I have to go that deep. Or maybe?

I know @Baptiste has developed even his own C++ software to track his expenses. Is this because there are not better tools indeed in the whole world?

I know Microsoft Money is gone. Are there MINT alternatives in the EU or Switzerland? What are they? How do you consolidate your banks?

Cheers. I appreciate your comments on any part of my numerous questions.

I am talking about your system and tools here.

Let me elaborate on this:

- it is only at the age of 40 (unfortunately) I've started to take care of my finance, from tracking it, to start with

- based on data collected I've started to build trends and signals

- I even employed ChatGPT with my own agents to process data for me, as ChatGPT is great at analyzing unstructured data

- I use XLS as a tool, as I didn't find anything better

- as IT and Software Engineer and a Product Guy I want to believe there is a better place than XLS.

So, what's your system? How do you track it? How often? To which details? Which categories?

Below is a real example of categories that I use.

Then I have columns per month. Actual CF, not planned. Not deviation analyses between PLAN vs. ACTUAL. Not sure I have to go that deep. Or maybe?

I know @Baptiste has developed even his own C++ software to track his expenses. Is this because there are not better tools indeed in the whole world?

I know Microsoft Money is gone. Are there MINT alternatives in the EU or Switzerland? What are they? How do you consolidate your banks?

Cheers. I appreciate your comments on any part of my numerous questions.