Hi,

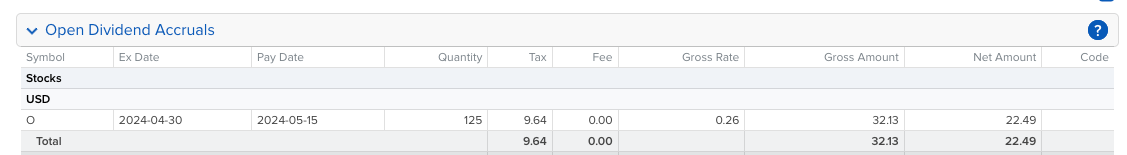

I recently opened an IBKR account and started investing in ETF/Stocks there. I invested in a US stock and it seems they withold 30% tax from the dividend. The dividend hasn't been paid out yet (Pay date is 15.05.2024, ex-date is 30.04.2024), but it seems I haven't filled out the W-8BEN form somehow, otherwise they would only withhold 15%, right?

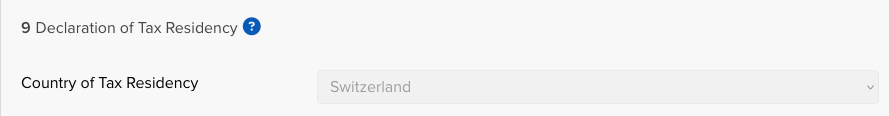

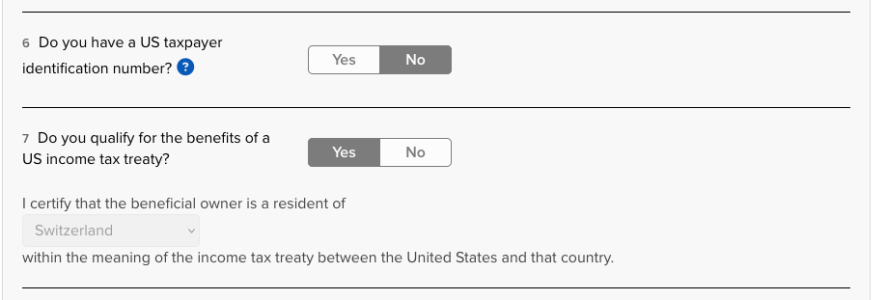

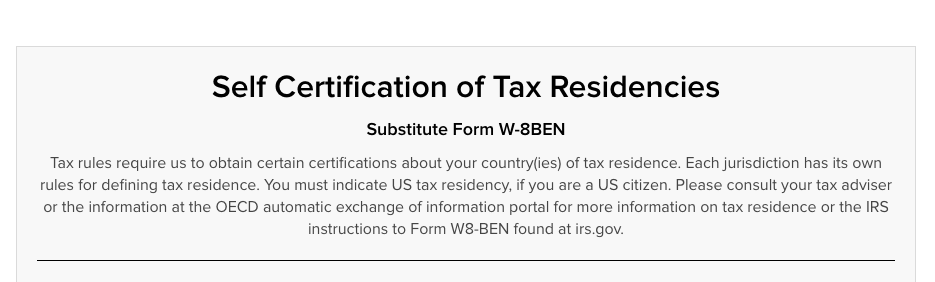

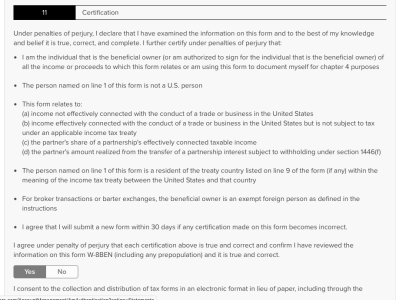

I checked in my settings and then profile information and there you can click on a link "Combined CRS/IRS Tax form" and it seems to me this is an electronic W-8BEN form or am I mistaken? Here a few screenshots from it:

If this is indeed the W-8EN form, why are they withholding 30% of the dividend? Can anyone please enlighten me?

I recently opened an IBKR account and started investing in ETF/Stocks there. I invested in a US stock and it seems they withold 30% tax from the dividend. The dividend hasn't been paid out yet (Pay date is 15.05.2024, ex-date is 30.04.2024), but it seems I haven't filled out the W-8BEN form somehow, otherwise they would only withhold 15%, right?

I checked in my settings and then profile information and there you can click on a link "Combined CRS/IRS Tax form" and it seems to me this is an electronic W-8BEN form or am I mistaken? Here a few screenshots from it:

If this is indeed the W-8EN form, why are they withholding 30% of the dividend? Can anyone please enlighten me?