You have to be careful about withdrawing money if you do not know when you will withdraw.

Indeed I can't tell when/if I will eventually need to withdraw from my invested money - as I said before, that would be in a very exceptional situation (emergency), where my emergency funds wouldn't be sufficient. So, yes: I would need to be careful in choosing the right moment in time (when I'm making surplus), if possible.

If you invest as a lump sum now, you can probably expect at least one -40% drop sometimes in the next 20 years. And if it's early, it means you will be fully in negative. And you will have to trust yourself not to sell.

Uh, interesting: where do you get that expectation from, to have a ca. 40% drop during the next 20 years?

So by "early" you mean that if the drop would happen let's say in 2026, I would have to keep my pace and not sell anything, waiting for the market to recover from the -40% drop - right?

And talking about "lump sum": if I close all my invested positions at UBS I will have 210k in cash, which I should not leave on an account. Thus, I'd be investing it with IBKR... at this point is it where you'd rather do DCA by putting e.g. 20k each month or so?!

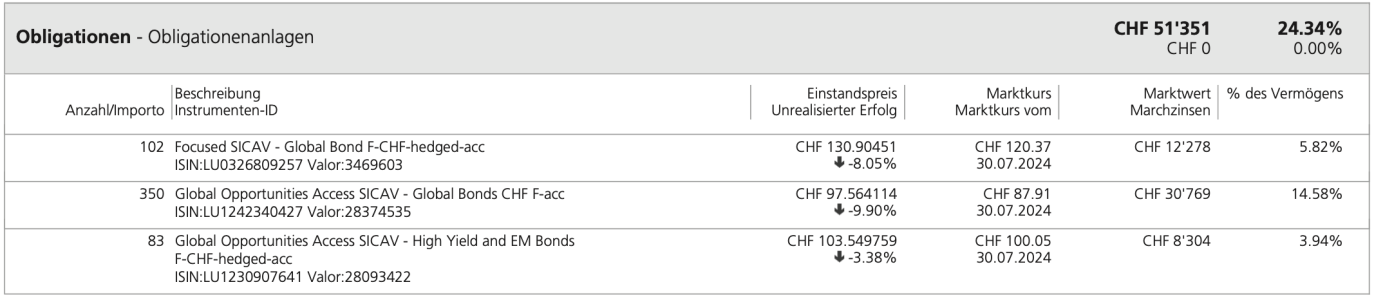

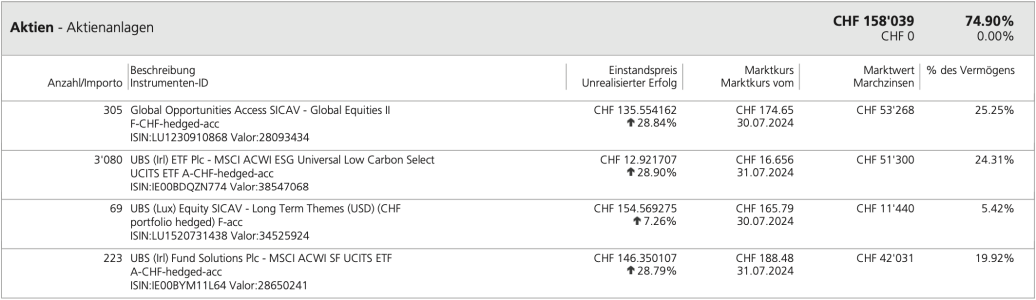

Yes, it does. In about 4 years, you did at most 28% in the best of your fund. There is nothing particularly good about these returns. Since June 5th 2020, VT did +42% until today.

Yes, I've seen that 28% and I was amazed - but probably because I'm a newbie and 28% looks great at first glance!

So you're saying that if I had invested the same amount of money back in 2020 in VT, today I wouldn't have made just +10.37% (which is what I've made as of today with UBS) but +42%?

I think you are overestimating the capacity of UBS to make money for you. Your stock portfolio would have done better 4 years in VT than in the portfolio you are mentioning. You will not necessarily have lower returns in IBKR with passive investing. This is of the biggest issues with active investing, you often have higher fees and lower returns.

Thanks for addressing this. Yes, probably overestimating UBS' ability to make money for me - first of all because I've just started the journey of taking care of my finances/wealth and second because I of course lack of experience in passive investing. I know that in finance there's nobody ever that can guarantee anything, but to me it's already worth to know and understand that VT is good for passive investing. I thought UBS made (and makes) more surplus with my money, but apparently (from your feedback) it's not true (compared to VT).