Any other https://yapeal.ch/private Users here? I've been with them for years. I'm still waiting for some features to drop (joint accounts, saving pods and so on) but they're very reliable, fast and have great support. That's my main salary account. I also use Postfinance for investments because I have to (I work for them).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Which bank do you use?

- Thread starter Baptiste Wicht

- Start date

Thanks for all your votes, keep them coming!

I find it impressive that so far 50% use UBS or CS, I was thinking it would be lower!

I find it impressive that so far 50% use UBS or CS, I was thinking it would be lower!

For example, I opened a free CSX account (in addition to neon) to have an option of depositing cash.I find it impressive that so far 50% use UBS or CS, I was thinking it would be lower!

CEA has currently the highest rate. 2%Why do you have so many accounts? Just to try them out?

GLKB i opened it in april as it was the best back then (1.55%). long term we'll see... it was a special offer at that time. if they keep 1.55% with sinking rates that may become interesting again

willbe has 1.55/1.25 with unlimited withdrawals and no notice period so perfect to park cash

yuh: i opened it before i realized CA offered all yuh offered. it doesn't hurt to keep it, but this is indeed redundant

neon for the mastercard without forex fees

Raiffeisen as it's impossible to open a neon bank when you still have US tax liability. And I needed a joint account. Debit cards are free in the first year, but now I need to think.

Just think it's a ridiculous to have to pay for a debit card. Free ATM withdrawals are nice but not used that often. I seldom use their webpage, almost only the App which works fine.

Just think it's a ridiculous to have to pay for a debit card. Free ATM withdrawals are nice but not used that often. I seldom use their webpage, almost only the App which works fine.

Yapeal: App looks really nice, clean and fast, but of course cannot do much there.

Kaspar&: Don't need their round-up thing and you cannot deactivate, only set at a minimum of 10 cents. Would like to be able to focus more on the bank account and be able to hide or so the investment stuff I don't need. But of course that is where they hope they can make their money

- Wanted to open an account with Neon bank because no fees on foreign transactions at market exchange rate and interests. Could have then cancelled Raiffeisen debit cards. However, the most annoying bank they are using. I waited until 2024 before opening the account, but as my Swiss passport was renewed when we were in the US, it says EDA instead of the canton where the passport was issued. Despite proof that I renounced my green card in 2023 and I do not have any tax liability in 2024, they declined and said that I am still US resident for tax reasons. Explained them how it works and nothing.

- I have then opened again one using my swiss ID, after over 1 week nothing

- I have then opened an account with Yapeal, matter of a day or so. Using Loyalty as I don't think it's worth to pay for Private. My main reason is to use their debit card for foreign tansactions. Would have been nice to have basic banking features or at least being able to do transfers and maybe have an interest rate

- Also opened one with Kaspar& as it allows at least to transfer bank money to the original bank account. I then called Neon bank and ended up at their partner bank and they asked me about Kaspar&. Told them I have opened both. They came up again with the US tax liability BS and told me they will also not opened the Kaspar&. Insisted that I do not have US tax liability anymore and a tax specialist was supposed to call back as it seems nobody understands the rules there. In the meantime Kaspar& was opened and I can see my money in there. Neon is still pending

Yapeal: App looks really nice, clean and fast, but of course cannot do much there.

Kaspar&: Don't need their round-up thing and you cannot deactivate, only set at a minimum of 10 cents. Would like to be able to focus more on the bank account and be able to hide or so the investment stuff I don't need. But of course that is where they hope they can make their money

Randindondan

New member

I personally use:

-Yuh as local payments bank, I find the app very well made and I like the idea of recieveing a Swisscoin after every purchase

-Neon to pay abroad or in any currency that is not CHF

-Migros Bank as joint account (me and my wife)

-Zak in case I need to withdraw large amount of cash

I'm all about free bank accounts! If you have better options please enlighten me!

-Yuh as local payments bank, I find the app very well made and I like the idea of recieveing a Swisscoin after every purchase

-Neon to pay abroad or in any currency that is not CHF

-Migros Bank as joint account (me and my wife)

-Zak in case I need to withdraw large amount of cash

I'm all about free bank accounts! If you have better options please enlighten me!

Last edited:

Just curious what do you really need Yuh for on top of Neon? I like that you can hold cash in EUR and USD for example. But otherwise?I personally use:

-Yuh as local payments bank, I find the app very well made and I like the idea of recieveing a Swisscoin after every purchase

-Neon to pay abroad or in any currency that is not CHF

-Migros Bank as joint account (me and my wife)

-Zak in case I need to withdraw large amount of cash

I'm all about free bank accounts! If you have better options please enlighten me!

What's your use case for Zak really? What do you mean with using it for large cash withdraw?

Randindondan

New member

I think Yuh is a better choice on top of neon because of the Swisscoin, which you get on each payment (I consider it a tiny cashback), and the interest rate of 1% per year (vs 0.9% of neon up to 25'000 and 0.65 after that). That's basically the only reason!Just curious what do you really need Yuh for on top of Neon? I like that you can hold cash in EUR and USD for example. But otherwise?

What's your use case for Zak really? What do you mean with using it for large cash withdraw?

And for Zak it happen once that I needed to withdraw a large amount of cash to buy a car and I couldn't just withdraw that amount from an ATM using yuh or neon, so after transferring the amount (around 40k CHF) to my Zak account, I went directly at the counter at a Cler Bank to withdraw it.

Hope I've been clear enough!

i use Yuh too as interest is good and very easy and quick to transfer to or from Swissquote as they use same platformI think Yuh is a better choice on top of neon because of the Swisscoin, which you get on each payment (I consider it a tiny cashback), and the interest rate of 1% per year (vs 0.9% of neon up to 25'000 and 0.65 after that). That's basically the only reason!

And for Zak it happen once that I needed to withdraw a large amount of cash to buy a car and I couldn't just withdraw that amount from an ATM using yuh or neon, so after transferring the amount (around 40k CHF) to my Zak account, I went directly at the counter at a Cler Bank to withdraw it.

Hope I've been clear enough!

Thanks for your insights. I don't know the Swissqoin to well, but didn't seem to be that valuable compared to use cashback from credit cards. Found it odd that it's based on transactions and not value and capped at 10.I think Yuh is a better choice on top of neon because of the Swisscoin, which you get on each payment (I consider it a tiny cashback), and the interest rate of 1% per year (vs 0.9% of neon up to 25'000 and 0.65 after that). That's basically the only reason!

And for Zak it happen once that I needed to withdraw a large amount of cash to buy a car and I couldn't just withdraw that amount from an ATM using yuh or neon, so after transferring the amount (around 40k CHF) to my Zak account, I went directly at the counter at a Cler Bank to withdraw it.

Hope I've been clear enough!

1% of interest is really good, but that 0.1 is not massive and I would not have the majority of the money there anyway. For larger amounts I use a higher yield savings account.

Again, not saying it's a bad account at all as I am using it as well. But really only because I can hold money in other currencies and the high interest rate. And mostly because Neon does not want to provide me an account.

Thanks RalphThanks for your insights. I don't know the Swissqoin to well, but didn't seem to be that valuable compared to use cashback from credit cards. Found it odd that it's based on transactions and not value and capped at 10.

1% of interest is really good, but that 0.1 is not massive and I would not have the majority of the money there anyway. For larger amounts I use a higher yield savings account.

Again, not saying it's a bad account at all as I am using it as well. But really only because I can hold money in other currencies and the high interest rate. And mostly because Neon does not want to provide me an account.

for larger amounts which account do you use if i may ask you ?

Hi Denis

Depends what you define as large amounts.

My situation is a bit different as I have moved back to Switzerland from the US a year ago. Most of my money is still in USD at IBKR and they pay a nice interest. Still waiting for the right moment to exchange a big chunk to CHF. Dollar is getting better again.

I have an account with Cler and using it until the 1.8% promo interest rate is ending. I have just opened a Cembra Savings Plus which gives me then 1.6%. My favorite account is Willbe with 1.3% for money I can tap into whenever needed. Also have great interest for EUR.

hope that is helpful

Depends what you define as large amounts.

My situation is a bit different as I have moved back to Switzerland from the US a year ago. Most of my money is still in USD at IBKR and they pay a nice interest. Still waiting for the right moment to exchange a big chunk to CHF. Dollar is getting better again.

I have an account with Cler and using it until the 1.8% promo interest rate is ending. I have just opened a Cembra Savings Plus which gives me then 1.6%. My favorite account is Willbe with 1.3% for money I can tap into whenever needed. Also have great interest for EUR.

hope that is helpful

and i discover NOW that their 1,80% int is valid only for a year starting your deposit... after the first year you get 0,80% only. additional amounts get 1,80% for a year and so on.yes a nice rate ! Banque Cler offers a nice 1,80% but the downside is you can withdraw 20k per year maximum or you loose 1%. Moreover you pay 3 frs for each payment and you can only withdraw 50 k maximum per year ...

Since 1.80% is above the SNB rates, it's not surprising.and i discover NOW that their 1,80% int is valid only for a year starting your deposit... after the first year you get 0,80% only. additional amounts get 1,80% for a year and so on.

We must always be careful about time-limited offers, because they often hide sub-par offers after the time-limited part.

Michael

Member

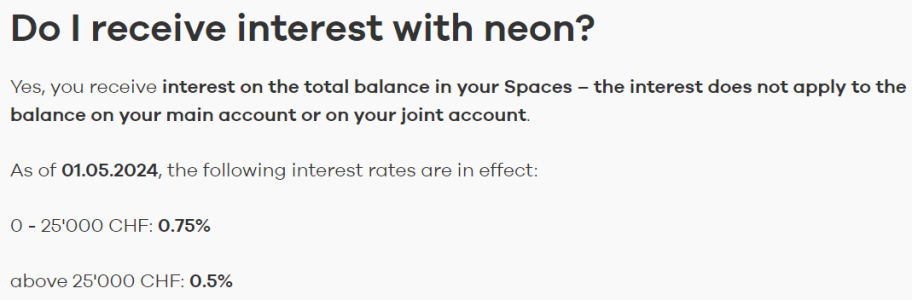

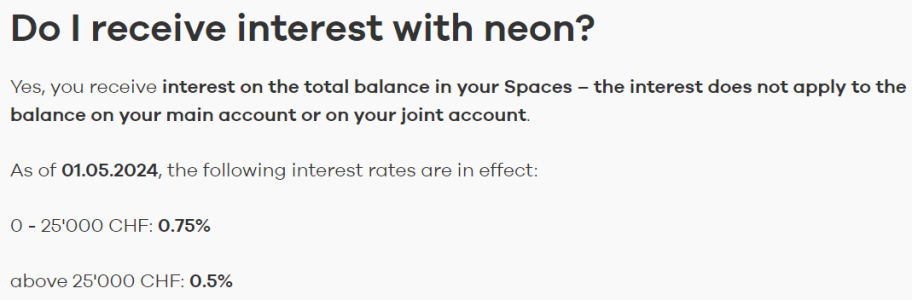

Neon lowering interest to 0.75% from tomorrow.

So if you have 20k on the account per year, that means one pays 50.-/year in lost interest when you compare it to another "flexible" (i.e. not limited by withdrawings etc) salary account such as Yuh (still 1%).

www.neon-free.ch

www.neon-free.ch

So if you have 20k on the account per year, that means one pays 50.-/year in lost interest when you compare it to another "flexible" (i.e. not limited by withdrawings etc) salary account such as Yuh (still 1%).

FAQ

Questions about neon or payments? Cash withdrawals, card fees, account opening, banking security - here you'll find the answer.

Most banks are reducing their interest rates since the SNB lowered the reference interest rate. Since I only keep my 10K emergency fund there, I really do not mind whether I get interest or not. But Neon was never a great place to hold a lot of cash.

here is the tricky part : after one year opening your account (not based on date amount deposited) banque Cler reduces the interest to 0,80% without advising you.yes a nice rate ! Banque Cler offers a nice 1,80% but the downside is you can withdraw 20k per year maximum or you loose 1%. Moreover you pay 3 frs for each payment and you can only withdraw 50 k maximum per year ...

gaijin

New member

I just went on their website to check for this offer (I remember the big billboard advertising), but don't see it on the website. Does the offer still exist?I have an account with Cler and using it until the 1.8% promo interest rate is ending.

Hello Together,

I recently see that Wir Bank open a free Bank account:

www.wir.ch

This offer seams to be better than Neon bacause there is no fee on cash withdrawal in foreign currency.

www.wir.ch

This offer seams to be better than Neon bacause there is no fee on cash withdrawal in foreign currency.

What do you think about this offer?

I recently see that Wir Bank open a free Bank account:

Paquet bancaire top

Le «paquet bancaire top» est le game-changer pour tous ceux qui s'intéressent à une offre de pointe pour le traitement des opérations bancaires quotidiennes.

What do you think about this offer?

Similar threads

- Replies

- 10

- Views

- 113