I have not yet looked at it in detail, but at first sight, it looks good. There are some conditions to this account, but they are not that difficult to meet. One small disadvantage would be that you would pay more for transfers in foreign currencies (not with the card, actual bank transfers). But few people use that. Another disadvantage is that you can't get any interest rate, but it may not matter to everybody.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Which bank do you use?

- Thread starter Baptiste Wicht

- Start date

gaijin

New member

According to their website: "Sie bezahlen keine Kommissionen, Gebühren oder Zuschläge auf dem Wechselkurs bei Zahlungen mit der Karte im Ausland." This sounds really interesting, a true alternative to Neon.This offer seams to be better than Neon bacause there is no fee on cash withdrawal in foreign currency.

https://www.wir.ch/de/produkte-loesungen/privatkunden/bankpaket-top

Last edited:

Indeed. But I am still surprised that they are offering the interbank exchange rate. Even Revolut stopped offering that rate. They would be the only one available with this rate, which would be great.This sounds really interesting, a true alternative to Neon.

Right now I am using Radicant as my salary, bills and emergency fund account. I really love the direction they're going right now, they have the highest interest on cash right now (1.25%), they have no FX fees (they use the interbank rate, no markup at all), and I like what they're doing in Kenya. I really hope they'll be able to grow and soon add more key features like sub accounts or push notifications for payments.

I also use Revolut, because it is the single best banking app if you want to track your expenses, their budget planner, their categories, everything works so well . It's the only reason I use them as my daily bank, for spending. I really hope a Swiss bank would offer something like this... (though I would still keep Revolut, because the virtual or single use cards are a good thing to have just in case).

I also have an account with Neon, but I don't really use it anymore because they don't have their own Twint (there have been instances where people send me money on UBS Twint and I only get it the day after on my Neon account...), the app is laggy (sometimes withdrawing money from Spaces fail), the app takes a few seconds too long to open compared to the others. Also they sent a lot of emails these last few months regarding their investment offers, they seem desperate for people to use them for investing... I keep them only in case Radicant were to fail like Flowbank.

I also use Revolut, because it is the single best banking app if you want to track your expenses, their budget planner, their categories, everything works so well . It's the only reason I use them as my daily bank, for spending. I really hope a Swiss bank would offer something like this... (though I would still keep Revolut, because the virtual or single use cards are a good thing to have just in case).

I also have an account with Neon, but I don't really use it anymore because they don't have their own Twint (there have been instances where people send me money on UBS Twint and I only get it the day after on my Neon account...), the app is laggy (sometimes withdrawing money from Spaces fail), the app takes a few seconds too long to open compared to the others. Also they sent a lot of emails these last few months regarding their investment offers, they seem desperate for people to use them for investing... I keep them only in case Radicant were to fail like Flowbank.

Yeah that's why I keep my Neon account, BLKB has set end of 2026 as a goal for Radicant to break even, let's see if they can grow, it's not looking very good... They have launched a 3a earlier this week, and they're also planning a saving plan for September. I suppose it's something like Neon, but some news sources call it "save-back" so I wonder if it isn't a form of cash back (like the Swisscoin with Yuh) that is invested or a Round-Up system like they have with Revolut.Thanks for sharing @Lelouch !

Radicant have really good accounts on paper indeed. The only thing bothering me is that they seem to be hemorrhaging money and I don't know how long will BLKB support their losses.

It's a shame Swiss Neo-banks seem to go all-in in the investment route, as that's what brings in the most money, and not take their time the way Revolut did, building and optimizing their app with great quality of life features (again the expenses tracker is excellent).

gaijin

New member

I am using Neon so far. This post made me look at Radicant and read Baptiste's review of it. My comments below are more about the review, especially the comparison with Neon.Right now I am using Radicant as my salary, bills and emergency fund account. I really love the direction they're going right now, they have the highest interest on cash right now (1.25%), they have no FX fees (they use the interbank rate, no markup at all), and I like what they're doing in Kenya. I really hope they'll be able to grow and soon add more key features like sub accounts or push notifications for payments.

For a bank account, I see many advantages for Radicant when compared to Neon:

- Higher interest

- Lower fx fees on credit card

- Their own Twint

In spite of these advantages, the review states "Radicant is not great if you want the cheapest bank account" and "As a bank account, it is not as attractive as other established bank accounts like Neon or Yuh." I do not understand these comments.

Of course I fully understand the "hemorrhaging money" aspect. So I would probably not recommend it long term. But this aspect is not mentioned in the review.

My guess is the article hasn't been updated with the new features.I am using Neon so far. This post made me look at Radicant and read Baptiste's review of it. My comments below are more about the review, especially the comparison with Neon.

For a bank account, I see many advantages for Radicant when compared to Neon:

- Higher interest

- Lower fx fees on credit card

- Their own Twint

In spite of these advantages, the review states "Radicant is not great if you want the cheapest bank account" and "As a bank account, it is not as attractive as other established bank accounts like Neon or Yuh." I do not understand these comments.

Of course I fully understand the "hemorrhaging money" aspect. So I would probably not recommend it long term. But this aspect is not mentioned in the review.

Up until March, Radicant had a 0.80% fee on foreign transactions. The interbank rate is a new feature by Radicant, started in April 2024 I believe.

It is indeed the best bank at the moment... on paper. But they are still missing some key features, like sub accounts and push notifications for card payments (it's a weird thing not to have). However, I think they're doing something great from a sustainability point of view, they also have good implementation of eBill (you can authorize payments from the app) and with the features you listed, I choose to use it as a main bank.

Where do you see this? I have updated the article 10 days ago with the latest changes from Radicant and this phrase is not present anymore.In spite of these advantages, the review states "Radicant is not great if you want the cheapest bank account" and "As a bank account, it is not as attractive as other established bank accounts like Neon or Yuh." I do not understand these comments.

You may be hitting a cached version of the article on your computer. You can do a hard refresh. And I will try to reduce the caching for the articles since I update them often.

The current version says:

Overall, both Radicant and Neon are great as bank accounts. They both have advantages and disadvantages and will offer a nice bank account.

gaijin

New member

Just checked again with different browsers and different OS. I still see the two phrases. The article seems to be up to date ("Updated: 04 July 2024").Where do you see this? I have updated the article 10 days ago with the latest changes from Radicant and this phrase is not present anymore.

I also see this phrase: "Overall, both Radicant and Neon are great as bank accounts. They both have advantages and disadvantages and will offer a nice bank account.". So you might have added the new phrase but not removed the old ones.

Thanks, I found it now it's in the FAQ, and it's separated from the main content  It's updated now!

It's updated now!

gaijin

New member

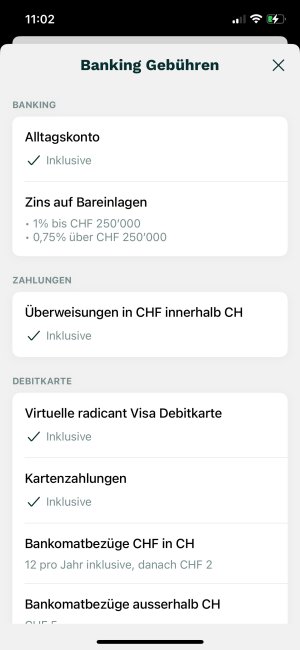

The interest seems to have changed to 1%. See attached screenshot.Right now I am using Radicant as my salary, bills and emergency fund account. I really love the direction they're going right now, they have the highest interest on cash right now (1.25%)

Attachments

Yes I just noticed the email I got from them! Not that much of a difference to be honest, they're in line with other banks and still have the best offer in that regard.The interest seems to have changed to 1%. See attached screenshot.

I saw that they completely redid their website as well... they will soon celebrate their 1st year anniversary since launch and looks like they are trying to branch out and not just stick with the sustainability angle. I'm really curious to see how that "Save-Back" (https://www.moneytoday.ch/news/neo-bank-radicant-neue-strategie-und-neues-3a-produkt) feature will be different from what Neon or Yuh offer.

gaijin

New member

I'm now in the process of making Radicant my main bank account for receiving salay and paying bills. So far two hickups along this journey:I am using Neon so far. This post made me look at Radicant

- Setup of ebill (essential tool for me) does not work. I see some introductroy pictures, the following link does not lead me to the right page (error message on a website with an ebill logo)

- Login failed after Face ID was accepted. Call with customer service gave me a general statement that there were problems with the login and that I would receive an email once solved. This call was yesterday morning, so far no email.

You may need to check your spam box, it happened to me when I got an email from their CS for a question I had.I'm now in the process of making Radicant my main bank account for receiving salay and paying bills. So far two hickups along this journey:

My current conclusion: interesting choice for 'beta testers' like me. But nothing that I would setup for my mother

- Setup of ebill (essential tool for me) does not work. I see some introductroy pictures, the following link does not lead me to the right page (error message on a website with an ebill logo)

- Login failed after Face ID was accepted. Call with customer service gave me a general statement that there were problems with the login and that I would receive an email once solved. This call was yesterday morning, so far no email.

I didn't have the problems you are facing with eBill or login though, my experience with it has been pretty smooth so far.

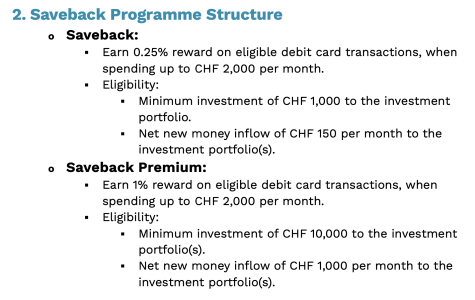

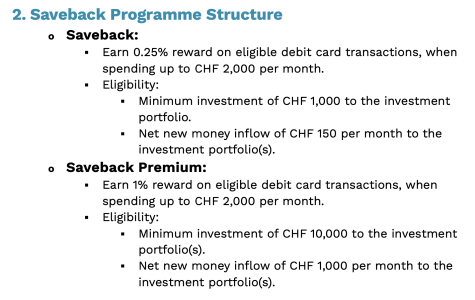

Radicant officially launched their "Saveback" program and wow, it's absolutely terrible. I was expecting a sort of cash back that, instead of going into your account, would go to an investment plan. But the conditions are astonishingly bad:

So I actually went to check their investment offer and... they have a management fee of 0.90% (now 0.45% until the end of the year) and the fund they use has a TER of 1.5%!

This offer is so bad that I am getting second hand embarrassment and am seriously considering closing my account with Radicant. If Yuh was named anything but "Yuh" I'd probably change for it in a heartbeat.

So I actually went to check their investment offer and... they have a management fee of 0.90% (now 0.45% until the end of the year) and the fund they use has a TER of 1.5%!

This offer is so bad that I am getting second hand embarrassment and am seriously considering closing my account with Radicant. If Yuh was named anything but "Yuh" I'd probably change for it in a heartbeat.

It makes sense that they focus on putting money to their investment since this is where they are going to make money. But the fact that you already must be a user of their investments and that the cashback is only 1% at most is not great because you would do as a good with a great credit card. I am not sure this will be enough to bring many users in. But for existing users, this is quite nice.

The main issue I see is the upper bound of 2000 CHF per month. For heavy users that will go higher this limit, they would still need another debit/credit card for optimization.

Just a small note: The TER of their funds is between 0.4 and 0.47% normally, not 1.5%.

The main issue I see is the upper bound of 2000 CHF per month. For heavy users that will go higher this limit, they would still need another debit/credit card for optimization.

Just a small note: The TER of their funds is between 0.4 and 0.47% normally, not 1.5%.

Randindondan

New member

Personally, I don’t think it’s a "terrible" option. It encourages people to invest, avoid credit card use (which often leads to overspending), and do so sustainably, which aligns with radicant’s core mission. The "saveback" feature also helps offset their higher custody fees, making it a worthwhile choice, in my opinion.

While there are cheaper alternatives available, for someone who values sustainable investing and isn’t focused on maximizing returns, I think this is a solid choice.

While there are cheaper alternatives available, for someone who values sustainable investing and isn’t focused on maximizing returns, I think this is a solid choice.

Isn't the 0.4-0.47% the management fee? From what I saw on their portfolio description, their Global fund also has an additional 1.5%TER.It makes sense that they focus on putting money to their investment since this is where they are going to make money. But the fact that you already must be a user of their investments and that the cashback is only 1% at most is not great because you would do as a good with a great credit card. I am not sure this will be enough to bring many users in. But for existing users, this is quite nice.

The main issue I see is the upper bound of 2000 CHF per month. For heavy users that will go higher this limit, they would still need another debit/credit card for optimization.

Just a small note: The TER of their funds is between 0.4 and 0.47% normally, not 1.5%.

I mean sure, but asking people to invest an initial 10k then 1'000 per month in a rather expensive investment strategy in order to get 1% cash back is a pretty weak offer for a bank that needs to attract new customers. I use Radicant as a main bank and fully believe they can do something good with banking in the future if they can grow and meet the heavy expectations from politics and the BLKB, but this just feels bad; then again I'm not a marketing specialist so what do I know.Personally, I don’t think it’s a "terrible" option. It encourages people to invest, avoid credit card use (which often leads to overspending), and do so sustainably, which aligns with radicant’s core mission. The "saveback" feature also helps offset their higher custody fees, making it a worthwhile choice, in my opinion.

While there are cheaper alternatives available, for someone who values sustainable investing and isn’t focused on maximizing returns, I think this is a solid choice.

Similar threads

- Replies

- 7

- Views

- 145